Tom Davis shares non-QM opportunities to capitalize heading into 2025

Housing Wire

OCTOBER 25, 2024

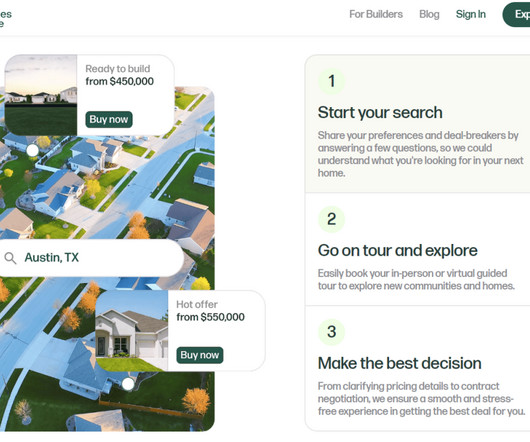

In this HousingWire Executive Conversation, Tom Davis, Chief Sales Officer at Deephaven , discusses the opportunities in the non-QM investor loan space as we head into the new year. Tom Davis: Investor transactions are still close to 28% of the overall purchase market. Many investors prefer to close in the name of an LLC.

Let's personalize your content