Portrait of a pre-foreclosure peacemaker

Housing Wire

OCTOBER 24, 2024

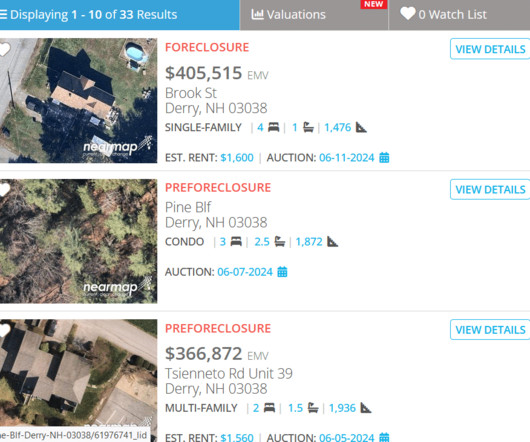

Although completed foreclosure auctions have plateaued in 2024 at less than half of pre-pandemic levels, the number of delinquent mortgages is close to pre-pandemic levels, according to an Auction.com analysis of public record data from ATTOM Data Solutions and survey data from the Mortgage Bankers Association (MBA). There is a lot of fear.”

Let's personalize your content