How loan originators survived a cutthroat mortgage business in 2023

Housing Wire

DECEMBER 28, 2023

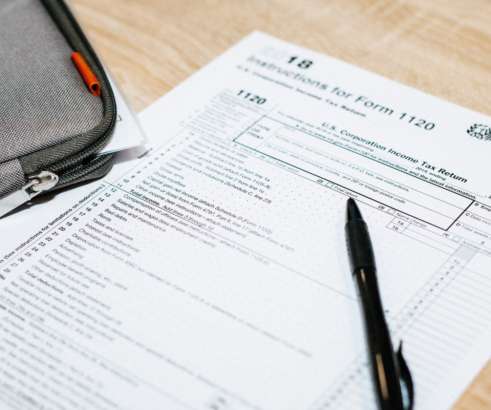

It was another brutal year, pushing loan originators to work longer hours, close loans faster while diversifying their mortgage product offerings. According to data from Ingenius , tens of thousands of loan officers exited the industry in 2023. An additional 21% closed 1.5 That’s the tactic that we take.”

Let's personalize your content