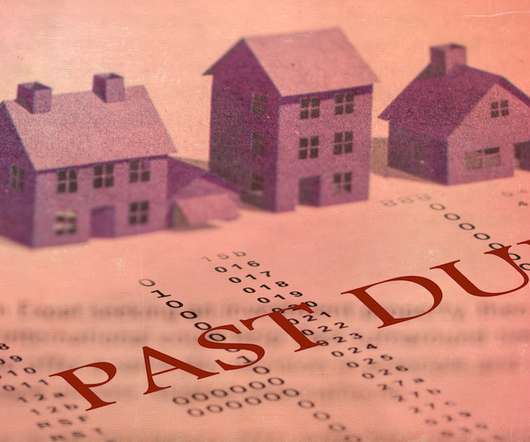

Cash-out refis are in high demand as equity levels skyrocket

Housing Wire

DECEMBER 7, 2021

Record home price appreciation in recent years has pushed tappable home equity to new heights. According to a report published by data vendor Black Knight this week, the third quarter of 2021 saw a nearly $250 billion dollar increase in tappable equity—a record. of available equity entering the quarter, the report said.

Let's personalize your content