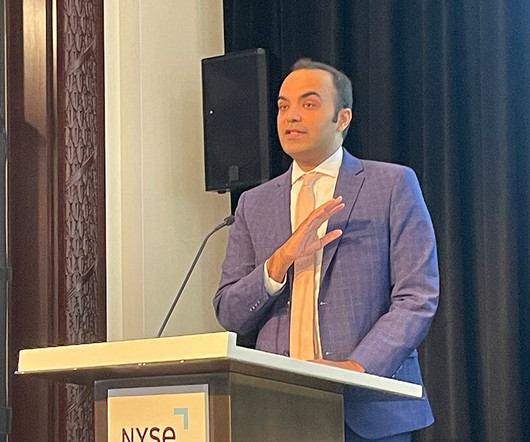

Rocket Mortgage will pay up to $5,000 in closing costs for renters

Housing Wire

FEBRUARY 18, 2025

Rocket Mortgage on Tuesday unveiled RocketRentRewards, which the company says is the homeownership industrys first offer to provide closing cost credits for renters. With the national average rent at $1,800, that translates to $2,160 applied toward a clients closing costs.

Let's personalize your content