Biden to call for first-time homebuyer tax credit, construction of 2 million homes

Housing Wire

MARCH 7, 2024

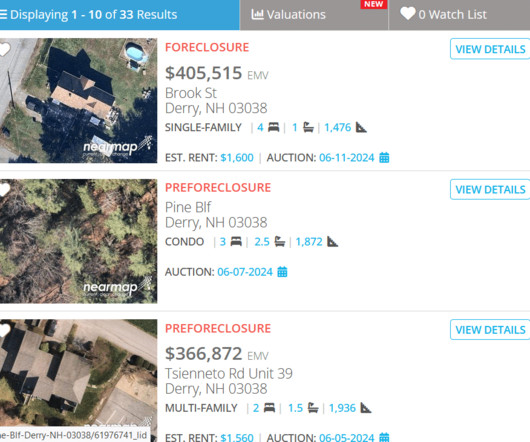

In the address, the president will call for a $10,000 tax credit for both first-time homebuyers and people who sell their starter homes; the construction and renovation of more than 2 million additional homes; and cost reductions for renters. It is also wary of some of the proposals.

Let's personalize your content