Nearly half of home sellers are offering concessions

Housing Wire

APRIL 21, 2025

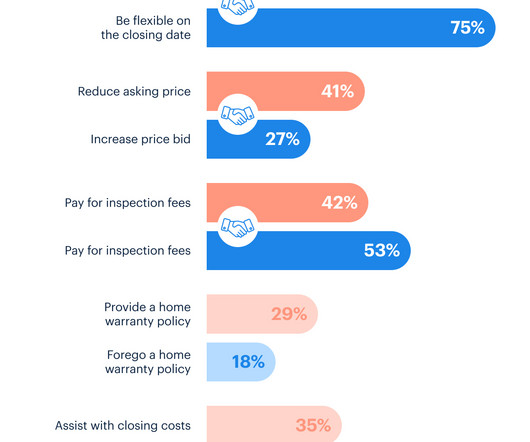

home sellers offered concessions to buyers in near-record numbers during the first quarter of 2025 as rising housing costs , high mortgage rates and growing economic uncertainty continued to reshape the real estate landscape. According to a new report from Redfin , 44.4% a year ago and close to the record figure of 45.1%

Let's personalize your content