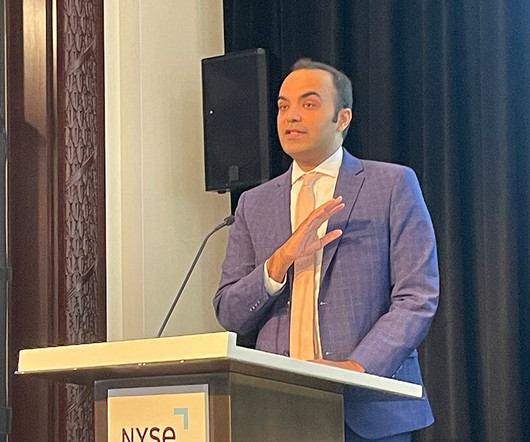

CFPB director open to changing mortgage regs to fix refi process

Housing Wire

SEPTEMBER 9, 2024

The mortgage industry has complained loudly and often that government regulation and investor requirements are contributing to spiraling costs that get passed on to consumers. We’re also looking at identifying ways to jumpstart competition in certain closing cost categories, which can also help spur more activity.

Let's personalize your content