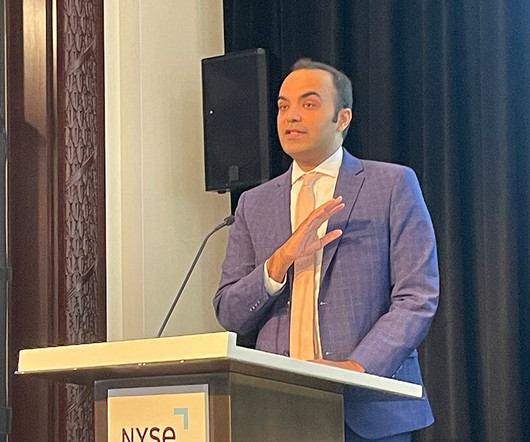

Tomo Mortgage closes $20M Series B funding round

Housing Wire

MARCH 11, 2025

Tomo Mortgage on Tuesday announced the closure of $20 million in Series B funding that was led by three existing investors and a new participant. The funding round was led by prior investors Ribbit Capital , DST Global and NFX along with new investor Progressive Insurance.

Let's personalize your content