2025 mortgage predictions: Your playbook for a winning year

Housing Wire

DECEMBER 9, 2024

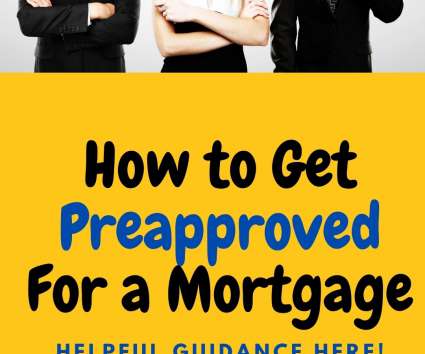

By March, were likely to see a healthy uptick in sales. Heres your game plan: Check your credit: A score of 640 opens the door to FHA loans and down payment assistance programs. Save strategically: Even with down payment assistance, youll need some savings for earnest money and closing costs.

Let's personalize your content