Opinion: The myth of financing buyer agent commissions

Housing Wire

AUGUST 30, 2024

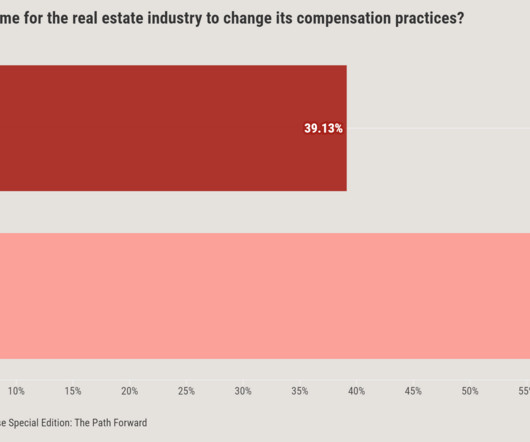

As a salve, a vocal minority of activists say that “simply” allowing the financing of buyer-agent commissions into mortgages will resolve all concerns. For reasons both practical and legal, buyer-agent commissions are not today explicitly financeable with a mortgage. But this is much easier said than done.

Let's personalize your content