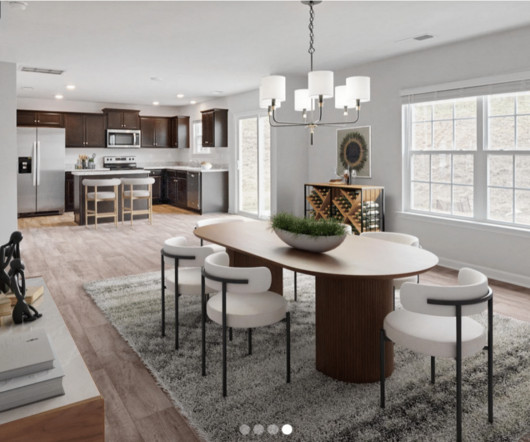

Borrowers exiting forbearance may choose to sell their homes – What role do servicers play?

Housing Wire

JULY 19, 2021

According to Black Knight , 96% of homeowners have at least 10% equity – meaning they may be able to pay off their loan, closing costs, and agent commissions without paying out of pocket or a short payoff. JC: There is no question that servicer capacity is a big issue.

Let's personalize your content