The 11 do’s and don’ts of buying a new build

Housing Wire

APRIL 18, 2025

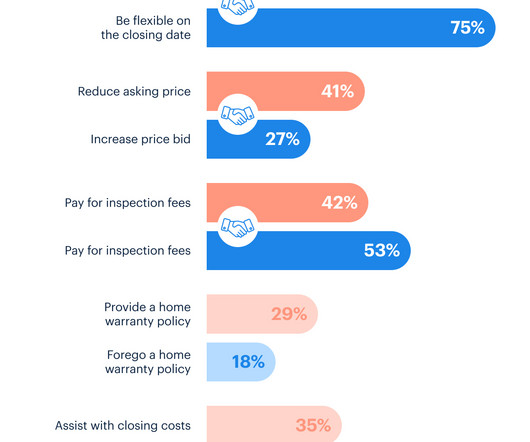

Navigating the home buying process often begins with deciding between a new build or an existing homeand while new construction offers exciting possibilities, it also comes with unique challenges. Many builders offer incentives or are open to negotiating closing costs, lot premiums and other expenses.

Let's personalize your content