How the Fed’s rate hike will affect the housing market

Housing Wire

JUNE 16, 2022

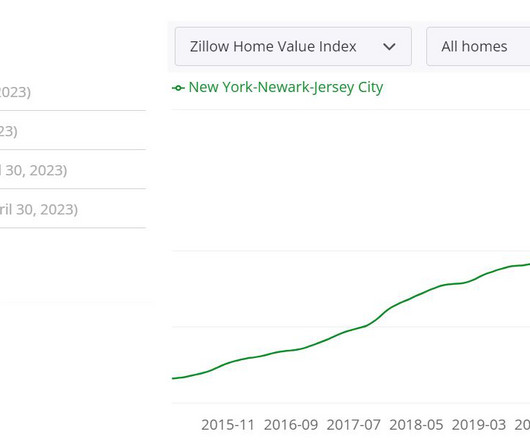

The federal funds rate doesn’t directly dictate mortgage rates, but it does steer market activity to create higher rates and reduce demand. It’s painful that on the same $300,000 mortgage, the monthly payment rose to $1,800 today from $1,265 in December. mortgage industry to fund $4.1 Labor Department.

Let's personalize your content