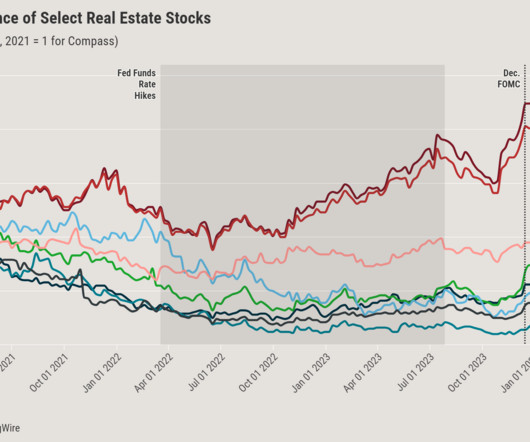

The mortgage rate pendulum swings yet again

Housing Wire

APRIL 17, 2024

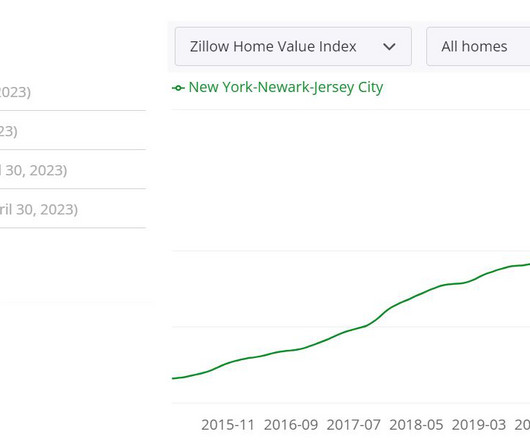

Expect 2024 to be mildly better than 2023 with mortgage rates falling in the second half of the year, housing experts opined in their forecasts at the end of the year. The pessimism is visible in mortgage rates. Freddie Mac ‘s weekly Primary Mortgage Market Survey is climbing back towards 7%.

Let's personalize your content