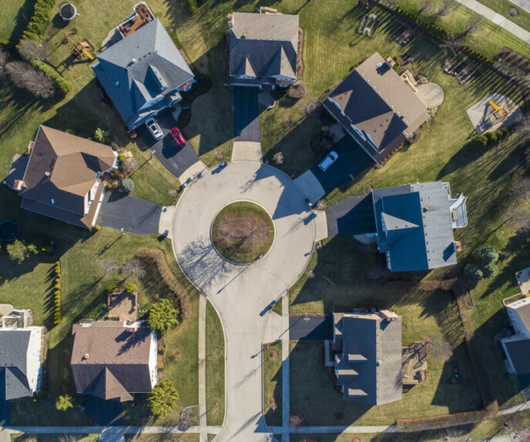

13 Tips for First-Time Homebuyers in Chicago

Redfin

MARCH 28, 2023

Get pre-approved for a loan before starting your home search The best advice I can give new buyers is to get pre-approved. Set up a meeting with your bank or mortgage lender and submit all the financial documents they request so they can pre-approve you.

Let's personalize your content