Foreclosure filings rose in October. Could this trend continue in 2025?

Housing Wire

NOVEMBER 13, 2024

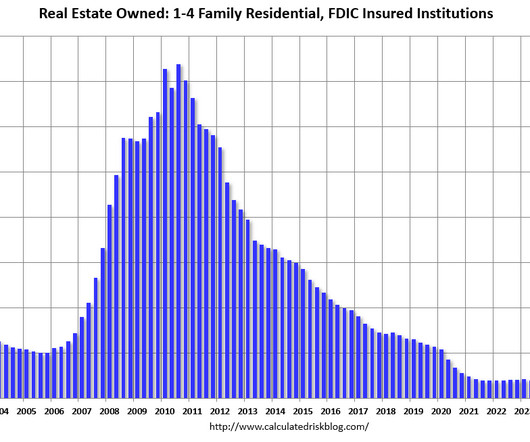

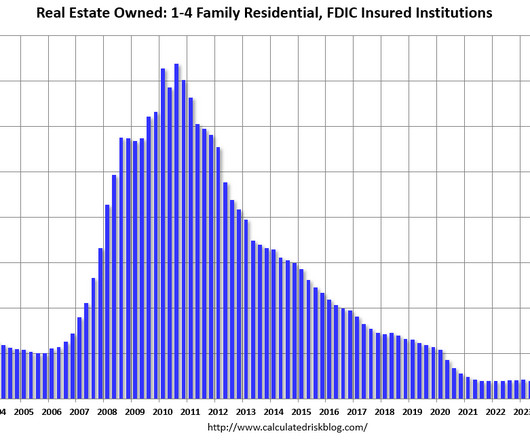

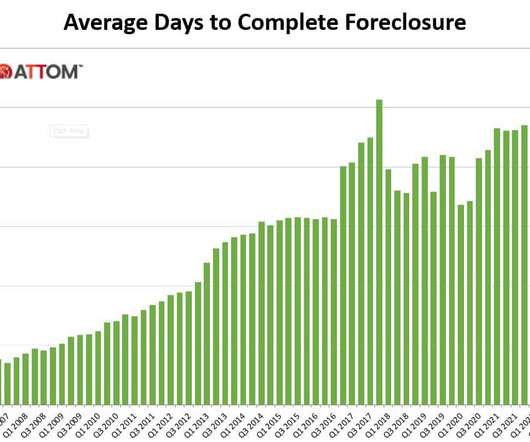

The report only considers homes in default, auction and real estate-owned (REO) status — i.e., those owned by a bank, government agency or another party after foreclosure. Only filings listed in the Attom data warehouse in Q3 2023 were considered, although the company noted that some filings may come from Q2 2023.

Let's personalize your content