Judge rules in favor of Ginnie Mae in lawsuit brought by Texas Capital Bank

Housing Wire

APRIL 3, 2025

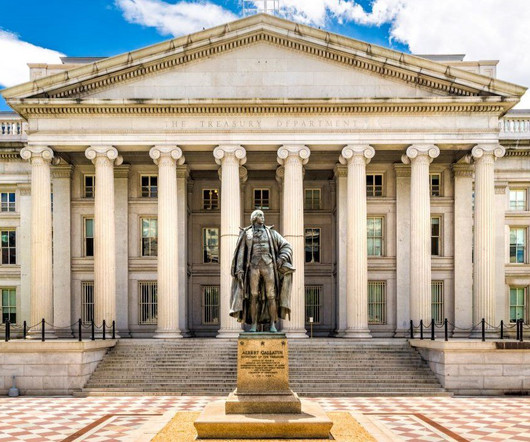

A lawsuit over rights to reverse mortgage-backed collateral stemming from the collapse of a major industry lender has been brought to an end with a summary judgment, but the plaintiffs in the case have vowed to appeal the decision. The suit was filed by Texas Capital Bank (TCB) against Ginnie Mae in late 2023. It chose mortgages.

Let's personalize your content