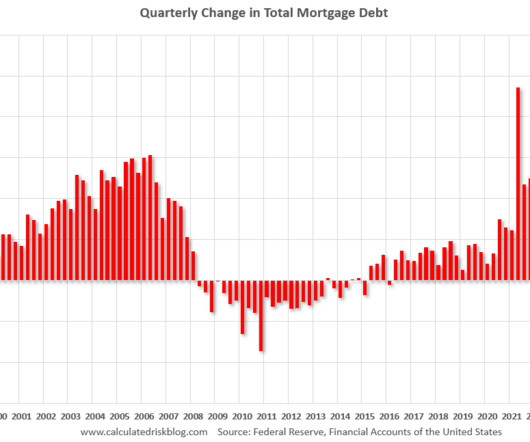

Banks report rise in mortgage delinquencies

Housing Wire

JULY 1, 2022

Banks reported an increase in foreclosures during the first quarter of 2022, according to a quarterly survey published by the Office of the Comptroller of Currency this week. Home forfeiture actions, including completed foreclosure sales, short sales, and deed in-lieu-of- foreclosure actions also grew by 26.8%

Let's personalize your content