“Last night, my Uber driver was a loan officer.”

Housing Wire

NOVEMBER 9, 2022

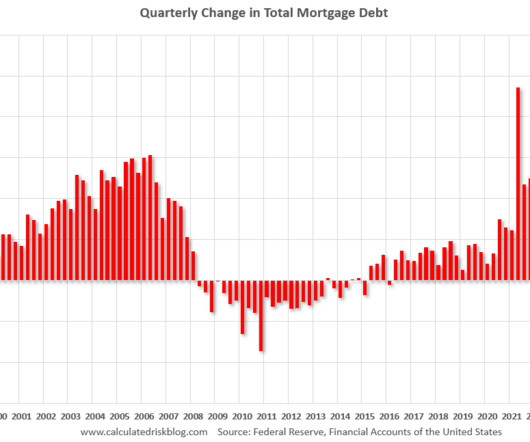

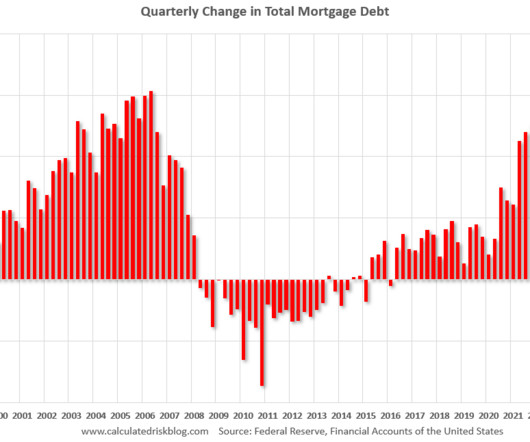

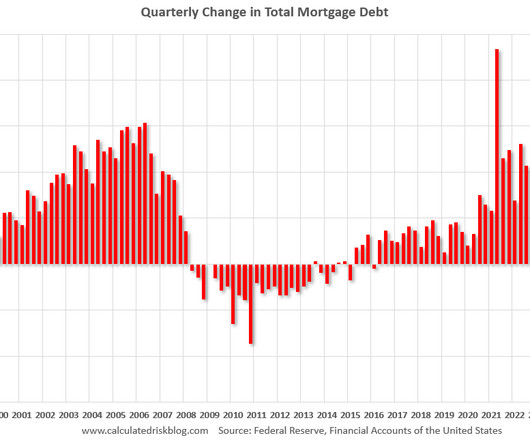

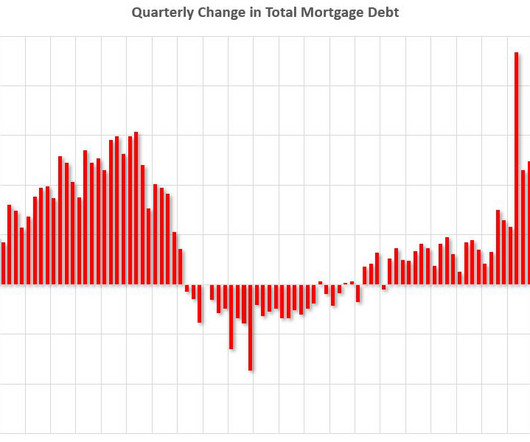

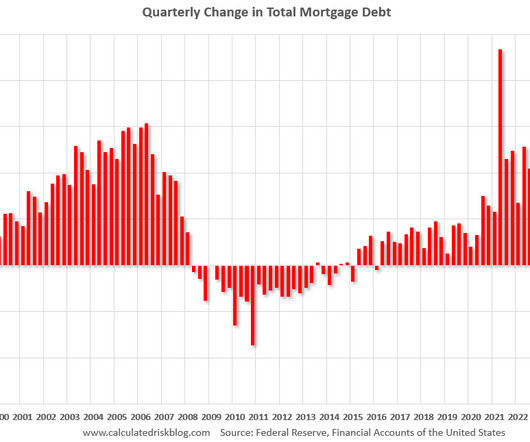

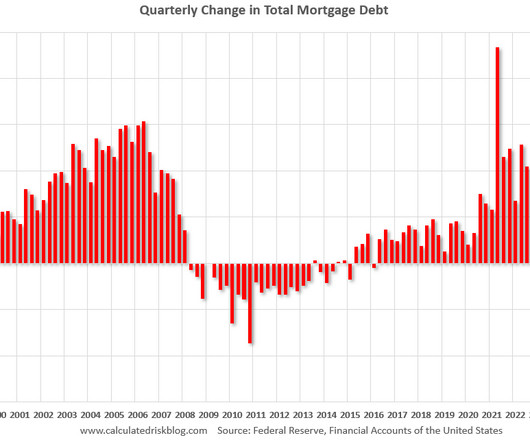

The steady drumbeat of dour news in the mortgage industry punctuated by headlines announcing layoffs and closures among the ranks of independent mortgage banks continues to play out, with several lenders over the last two weeks adding to the torrent of pink slips. Charting the loan officer exit.

Let's personalize your content