Mortgage lenders, borrowers react to banks closures

Housing Wire

MARCH 15, 2023

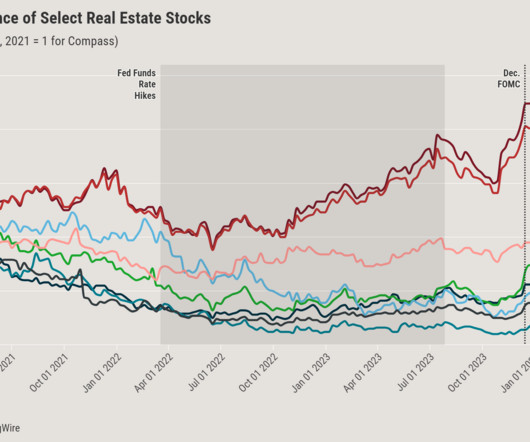

The Silicon Valley Bank and Signature Bank failures that occurred over the last week have caused even more uncertainty within the mortgage industry. Still, homebuyers took advantage of declining rates provoked by the turbulence and applied for home loans. retail residential mortgage applications.

Let's personalize your content