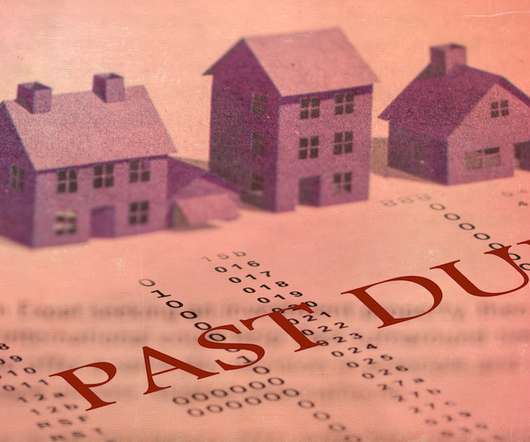

Bank of America mortgage origination volume jumps 66% in Q2

Housing Wire

JULY 16, 2024

Mortgage production increased at Bank of America (BofA) in the second quarter of 2024 compared to the previous three months, but the bank’s home loan volumes were still lower than those delivered in the same period last year. BofA’s loan production in the home equity arena also increased on a quarterly basis.

Let's personalize your content