Home sellers who didn’t list on the MLS lost $1B in sale proceeds: Zillow

Housing Wire

MARCH 24, 2025

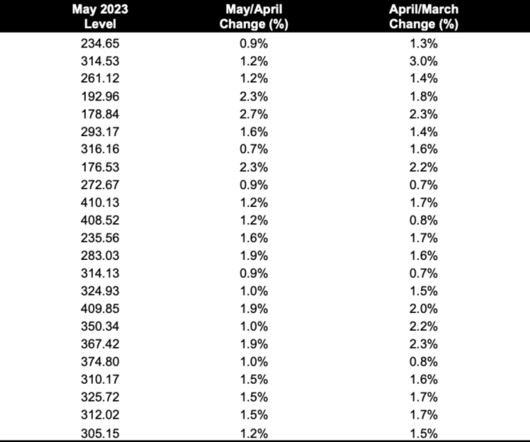

It excludes new construction homes , foreclosure sales, auction sales, non-arms-length transactions, bank/corporate/government acquisitions, invalid quit claims and outlier sale prices (defined as below $10,000 or above $10 million). Zillow said only this subset of off-MLS transactions was included in the analysis.

Let's personalize your content