CFPB director open to changing mortgage regs to fix refi process

Housing Wire

SEPTEMBER 9, 2024

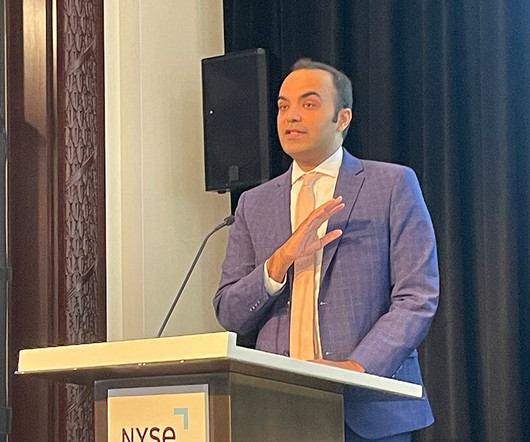

“We really think closing costs can be a significant obstacle to refinancing,” Chopra said at an AI and technology conference jointly hosted by ICE Mortgage Technology and the National Housing Conference at the New York Stock Exchange on Monday. At least when it comes to redundancies with refinancings, that is.

Let's personalize your content