Are Closing Costs Tax Deductible When Selling a House?

HomeLight

OCTOBER 31, 2024

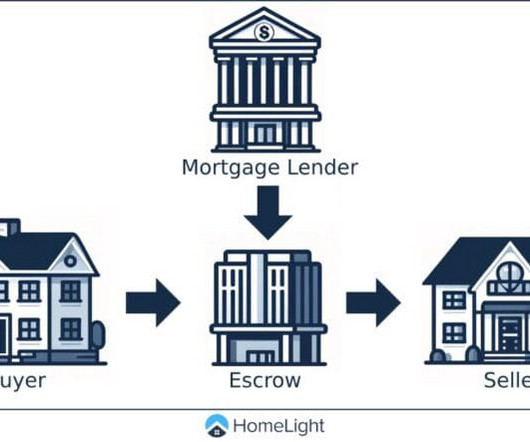

In this post, we explore the question: Are closing costs tax deductible? What are examples of seller closing costs? When selling a home, you’ll encounter various closing costs as part of the process. On average, sellers pay between 2% and 5% of a home’s sale price in closing costs.

Let's personalize your content