Sagent’s mortgage platform, Dara, moves closer to full deployment

Housing Wire

FEBRUARY 4, 2025

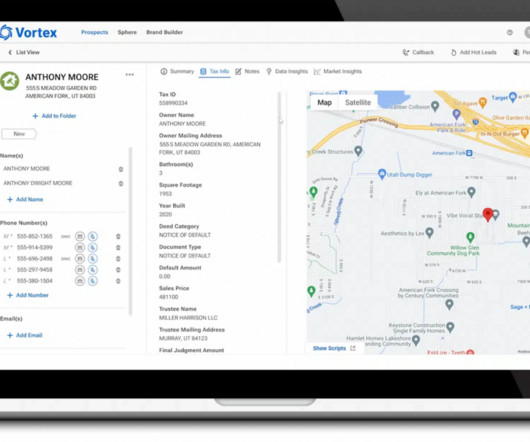

Dara Movement and Dara Data are not yet on the market but in a “road map” stage, Sagent confirmed. Dara Default offers decisioning, automated workflows, collections, loss mitigation, claims, foreclosure and bankruptcy and an attorney network. And Dara Core is nearing beta completion.

Let's personalize your content