CFPB received fewer reverse mortgage complaints in 2024

Housing Wire

JANUARY 24, 2025

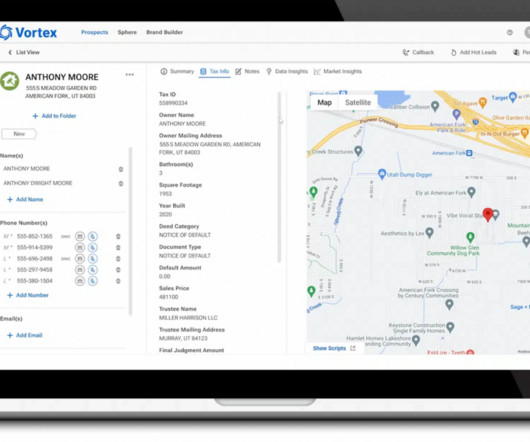

Most of the other half stemmed from trying to communicate with the company to fix an issue related to modification, forbearance, short sale, deed-in-lieu, bankruptcy, or foreclosure, according to the database. About 13% of all complaints were related to applying for a loan or refinancing an existing one.

Let's personalize your content