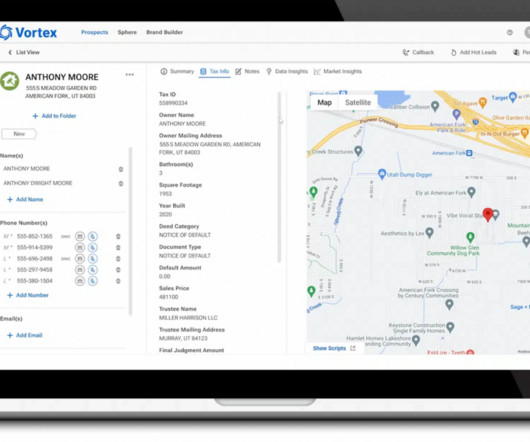

Portrait of a pre-foreclosure peacemaker

Housing Wire

OCTOBER 24, 2024

Helping the homeowner file for bankruptcy is another tool in the pre-foreclosure peacemaker’s tool kit, but Sandoval uses that tool with caution. “I An Auction.com analysis of bankruptcy data from the American Bankruptcy Institute shows a steadily rising level of Chapter 13 filings, which reached a new post-pandemic high in June 2024.

Let's personalize your content