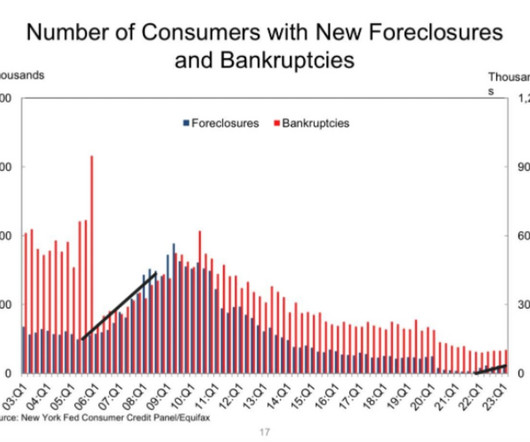

Nonbank Hometown Lenders files for bankruptcy

Housing Wire

JUNE 4, 2024

Hometown Lenders has filed for Chapter 11 bankruptcy protection in Alabama, blaming the Federal Reserve’s policy to curb inflation for its debacle. Most were conventional (67%) and purchase (75%) loans. The Modex data shows that it originated about $900 million in loans that year. billion in 2022, compared to $5.5

Let's personalize your content