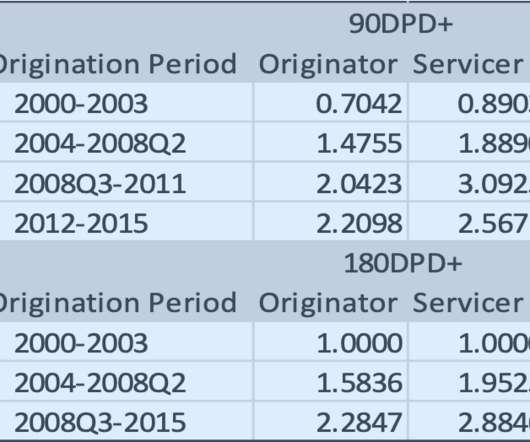

No, homeowner delinquency rates aren’t elevated

Housing Wire

MARCH 30, 2025

These loans pertain to multifamily mortgages, which are used for commercial properties with five or more units, such as apartment buildings. However, there is a big difference between apartment lending and homeowners who have a 30-year fixed-rate mortgage.

Let's personalize your content