Figure partners with NovaWulf on proposed reorg of crypto lender Celsius

Housing Wire

FEBRUARY 17, 2023

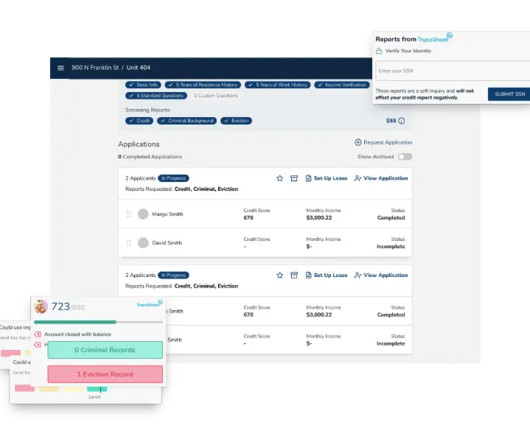

Fintech Figure Technologies will partner with NovaWulf Digital Management to provide blockchain technology solutions for a proposed reorganization of troubled crypto lender Celsius. Cagney’s attempt to bring blockchain technology to mortgage lending at scale dates back to August 2021. Figure Acquisition Corp.,

Let's personalize your content