How Long Does It Take to Close On a House With Cash in 2022? Here’s Your Timeline

HomeLight

MAY 24, 2022

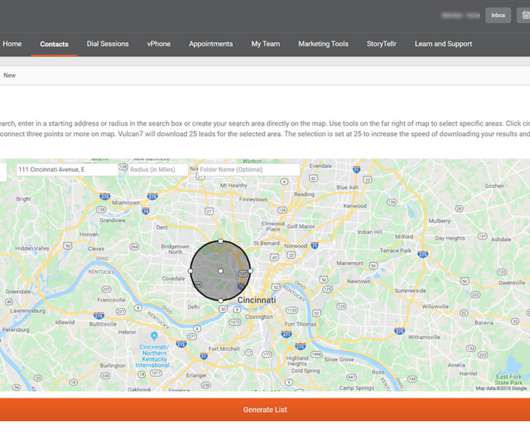

If you only pay cash for the down payment, and take out a mortgage for the remainder of the purchase price, it keeps more money in your pocket. Even though it’s all cash to the sellers at closing, with a cash offer, “you don’t have to go through the appraisal or the bank approval process — it’s cleaner.”. A cash sale: Start to finish.

Let's personalize your content