Non-QM lenders are back. But will brokers pick up the phone?

Housing Wire

NOVEMBER 10, 2020

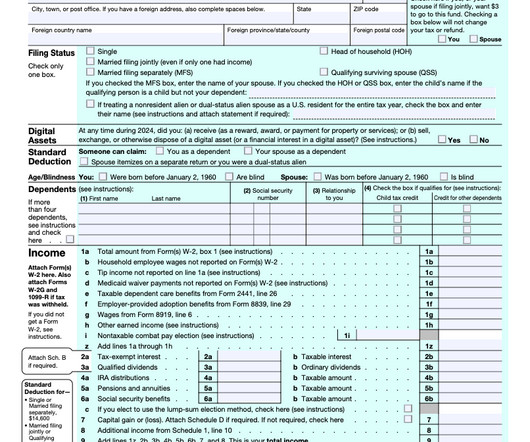

But unlike Fannie and Freddie, most non-QM loans rely on the borrower’s credit score and the loan-to-value ratio on the loan, rather than the debt-to-income ratio. For eight years they were not able to get a mortgage loan – they could have an 800 credit score, $2 million in the bank. That’s when we get ‘em.

Let's personalize your content