Pre-Approval Makes All the Difference When Buying a Home

Keeping Current Matters

JUNE 22, 2021

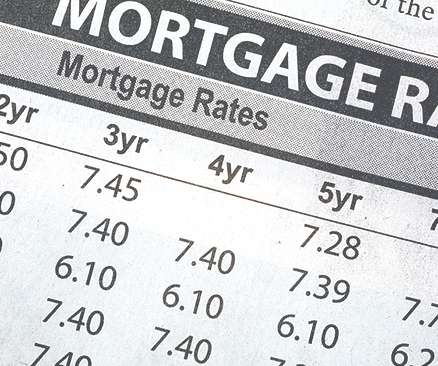

You may have been told that it’s important to get pre-approved at the beginning of the homebuying process, but what does that really mean, and why is it so important? Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. offers for sellers to consider.

Let's personalize your content