Century 21 CEO talks industry consolidation, filling market gaps

Housing Wire

JUNE 17, 2025

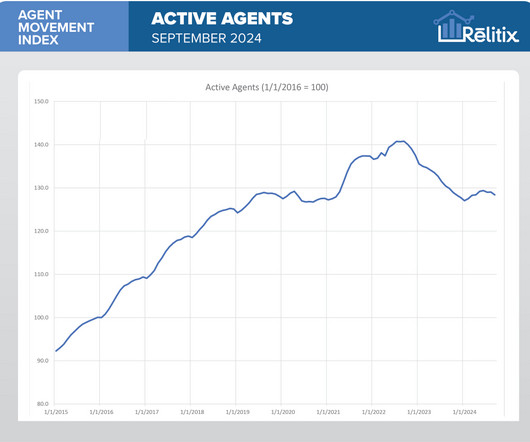

As the real estate industry faces unprecedented transformation, Century 21 Real Estate has stayed active through aggressive franchise growth, market consolidation and engagement with evolving homebuyer demographics. What’s driving this level of expansion and how does it fit into where the industry is heading?

Let's personalize your content