Is technology the problem, not the solution, in the mortgage industry?

Housing Wire

OCTOBER 27, 2024

The mortgage industry has long been promised a technological revolution to streamline workflows, reduce operational costs, and enhance efficiency. Yet, despite significant investments in new technologies, the cost to originate loans has dramatically increased. Complex systems may require extensive training and adjustment periods.

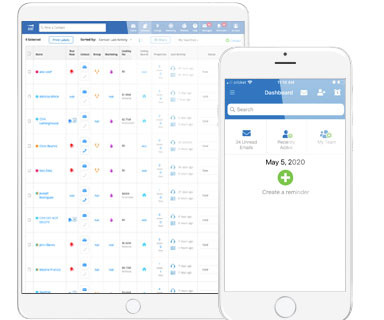

Let's personalize your content