More homebuyers seek government-backed loans as an affordability lifeline

Housing Wire

FEBRUARY 3, 2025

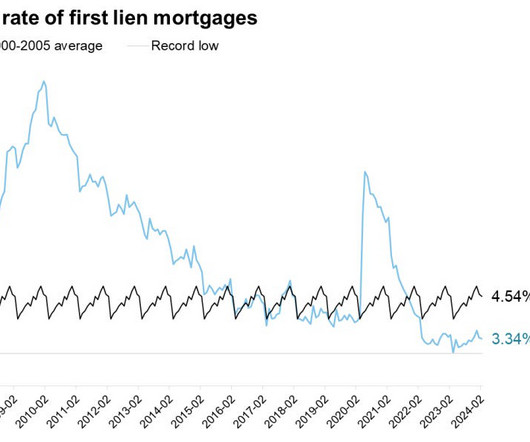

The company’s newest National Housing Market Outlook shows that buyers are gravitating toward government-backed loans in their search for affordability. The Burns Affordability Index, which measures the ratio of housing costs to income, is now at 42.4%, a figure that’s well above the historic norm of 32.8%.

Let's personalize your content