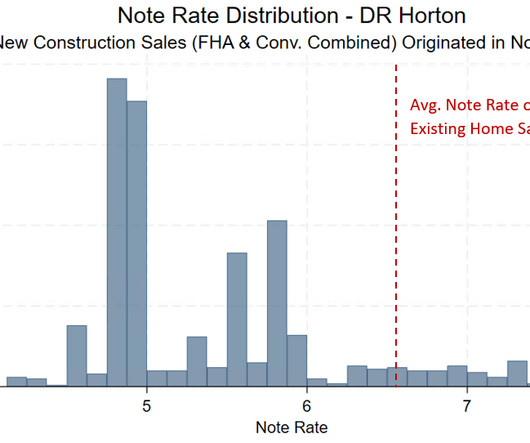

More homebuyers seek government-backed loans as an affordability lifeline

Housing Wire

FEBRUARY 3, 2025

The Burns Affordability Index, which measures the ratio of housing costs to income, is now at 42.4%, a figure that’s well above the historic norm of 32.8%. Louis -based Better Rate Mortgage , noted that in his local area, FHA loans are more common for those with higher debt-to-income ratios.

Let's personalize your content