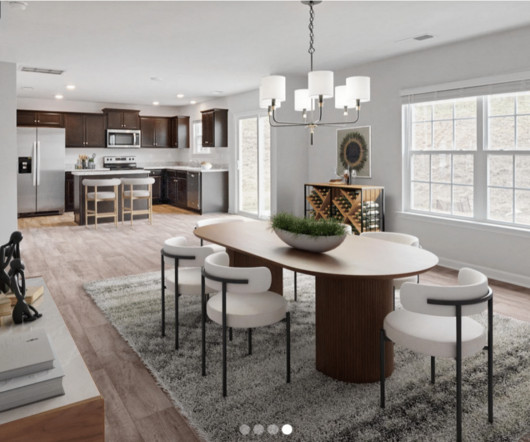

First-time homebuyers are being insulated by slower market conditions. Will it last?

Housing Wire

OCTOBER 29, 2024

31, 2023, and has since reshaped the business practices for real estate brokerages and agents across the country. And it is a little bit early, but some of the preliminary data I have looked at show that sellers are continuing to pay buyer agent compensation.” It is no secret that many first-time homebuyers are struggling.

Let's personalize your content