High mortgage rates sideline homeowners from tapping home equity: ICE

Housing Wire

DECEMBER 3, 2023

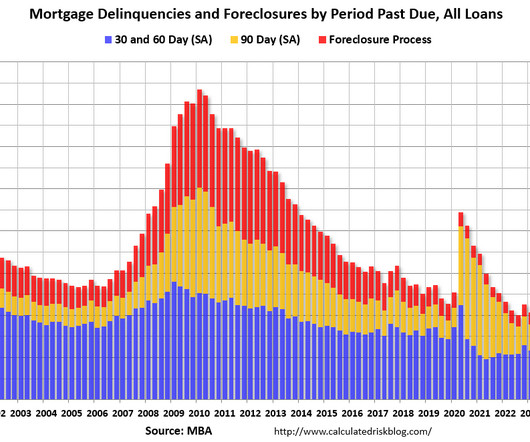

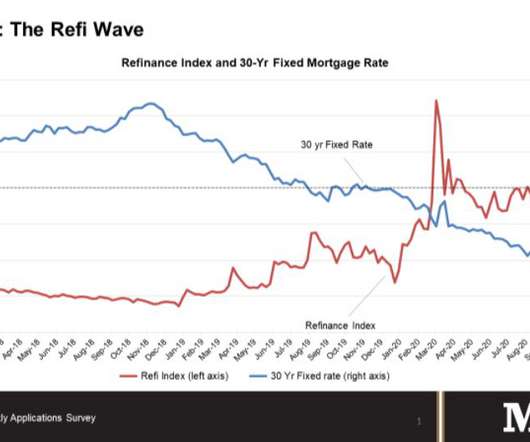

Rising home prices have pushed the third quarter’s tappable home equity amount near its 2022 peak, but interest rates are making homeowners reluctant to extract that wealth. for FHA loans and 44.5% for VA loans. These figures are both up sharply from recent months, but slightly below last year’s high of 45.7%

Let's personalize your content