How To Calculate Debt-To-Income Ratio

Bigger Pockets

MAY 29, 2023

A sound understanding of how to calculate debt to income ratio is critical for investors. We explain the formula you need to get your DTI.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Bigger Pockets

MAY 29, 2023

A sound understanding of how to calculate debt to income ratio is critical for investors. We explain the formula you need to get your DTI.

Housing Wire

APRIL 24, 2024

To prove his point, Middleman said that he is seeing average loan-to-value ratios of 50%, average debt-to-income ratios in the lower 40% range, and credit scores in the low 700s, which is an ”extraordinary” credit profile, he said. compared to the previous year.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Housing Wire

MAY 8, 2023

Louis, Missouri-Illinois Program borrowers also need to meet the lender’s eligibility requirements, which typically include a minimum credit score of 620 and a maximum debt-to-income ratio of 50%. For those who make between 50.01% and 80% of AMI, there is up to $1,250 worth of assistance available.

Housing Wire

MARCH 25, 2021

Contrary to popular belief, not every millennial is struggling with their finances. Having student debt shouldn’t stop you from buying, just as long as your wallet is in good condition. Your Debt-To-Income Ratio Is High. How much of that money do you use to pay off debt? What if your dishwasher breaks?

Housing Wire

JANUARY 20, 2021

To find a qualified lender, you need a good credit score and a good debt-to-income ratio, which is the percentage of a consumer’s monthly gross income that goes to paying down debt. Before you start searching for a lender, check your credit score and debt-to-income ratio.

Real Trends

MARCH 8, 2023

What do you do when your buyer’s financing is denied? The following tips are tried and true solutions to financing issues! Ratio issues What does this even mean? Lenders require specific debt-to-income ratios in order to qualify a borrower for a mortgage loan. The secret is to manage your mindset.

Housing Wire

MARCH 3, 2024

The market in which these folks purchased their first home was one of record house prices, ballooning down payments , rising rates and elevated debt-to-income ratios (DTIs).

Housing Wire

APRIL 7, 2021

Your Income Is Stable. How are your finances? A stable income means you’re more likely to be approved for a loan , than someone with an unstable income. Not to mention, if your finances are solid, you’ll be able to afford all those extra housing expenses. Most lenders prefer borrowers with a DTI lower than 36%.

Housing Wire

FEBRUARY 5, 2024

Under such a scenario, more than half would be homeowners who financed in 2023, with less than 10% coming from 2022-vintage loans. of the median household income, the average payment is down from a 38-year high of more than 38% in October. million to 3.8 Nearly 60% of that growth would come from loans originated in 2023, ICE projected.

Housing Wire

JANUARY 20, 2023

The Federal Housing Finance Agency this week made a series of significant changes to loan level pricing adjustment (LLPA) fees charged by Fannie Mae and Freddie Mac on conventional/conforming mortgages. The changes are effective starting May 1, 2023.

Housing Wire

MARCH 15, 2023

Following a chorus of complaints from the mortgage industry, the Federal Housing Finance Agency (FHFA) on Wednesday announced that it would delay the implementation of a new and controversial upfront fee on Fannie Mae and Freddie Mac borrowers with higher debt-to-income ratios.

Housing Wire

DECEMBER 12, 2023

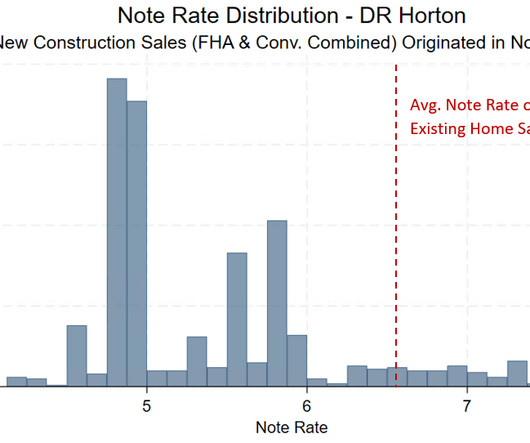

In this case, the total debt-to-income ratio (DTI) would be 51% and would exceed the Fannie Mae or Freddie Mac DTI limit of 50%. This suggests that DR Horton was offering the greatest buydowns to the most income-constrained borrowers in order to qualify more of them for financing. permanent rate buydown to 6%.

Housing Wire

APRIL 26, 2023

Federal Housing Finance Agency (FHFA) Director Sandra Thompson issued a statement Tuesday to correct the misinformation that’s spread about the agency’s loan-level pricing adjustments to conventional mortgages. No change is more controversial than the LLPA tied to a borrower’s debt-to-income ratio.

HomeLight

MARCH 12, 2024

Most Americans financing a house will typically use a conforming loan, which means it “conforms” to guidelines that allow the loans to be sold to Fannie Mae or Freddie Mac, two of the largest mortgage buyers in the country. A non-conforming mortgage loan stands apart from the crowd of standard financing options.

Housing Wire

AUGUST 22, 2020

According to reporting by the Wall Street Journal on Saturday, the Federal Housing Finance Agency has been communicating with mortgage industry groups about delaying the implementation of a fee which would add a 0.5% surcharge to refinance mortgages sold to Fannie Mae and Freddie Mac starting Sept.

Inman

MAY 10, 2023

Lending industry groups like the Mortgage Bankers Association called a fee based on borrower's debt-to-income ratio "unworkable."

Realty Biz

SEPTEMBER 30, 2023

Let's delve deeper into these topics to guide you towards an affordable home financing solution. In addition to credit scores, lenders also consider factors such as your income, employment history, savings, current debts, and the value of the home you intend to purchase. Reduce your existing debt.

Housing Wire

MAY 4, 2022

A housing bubble can generally be defined as an unsustainable period of house price growth generated by artificial demand, as was the case in the mid-2000s when demand surged because of wider access to mortgage financing. The mortgage debt-to-income ratio is near a four-decade low and homeowner equity is at a historic high.

Lighter Side of Real Estate

SEPTEMBER 8, 2021

Changing your debt-to-income ratio. Debt-to-income ratio is one of the most important factors lenders use to determine how much house you can afford—and, as such, what mortgage amount you’re approved for. Acting as a “red flag” to your lender. The Takeaway: So, what does this mean for you?

Realty Biz

FEBRUARY 22, 2024

Key Takeaways from this Article Gather all documentation to get pre-approved, including your SSN, proof of income, banking information, and tax forms. Make sure all your finances are squared away, including disputing incorrect data on your credit report or paying off existing debts to signal to lenders you can afford your mortgage.

Housing Wire

JUNE 4, 2021

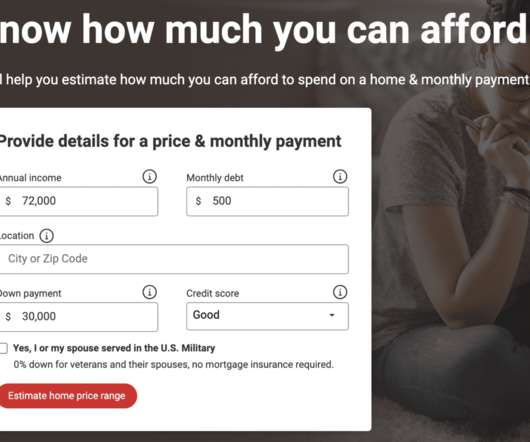

Your score will determine your financing options for buying a house. To determine what kind of house you can afford, you need to analyze your debt-to-income ratio (DTI). Your DTI shows how much money you put towards debt each month, and it’s relatively simple to calculate. . Step 1: Know Your Credit Score.

Realty Biz

SEPTEMBER 5, 2023

One crucial aspect of this process is ensuring that your finances secure a mortgage and make the dream of homeownership a reality. We will delve into essential strategies to improve your finances, focusing on utilizing tools like Credit Karma or Credit Sesame to prepare yourself for purchasing a house.

Realty Biz

APRIL 5, 2022

Manual underwriting is similar to automated underwriting system approval except there is lower debt to income ratio cap. Higher debt to income ratio borrowers need up to two compensating factors. Lenders offer 100% financing on VA loans. ? Debt to Income Ratio on Manual Underwriting.

Realtor.com

FEBRUARY 2, 2023

To up your chances of being approved—at a favorable rate—it’s always smart to pay down debts or pay off existing loans to the best of your ability. Whether you choose to lease or finance a car, you’ll increase your total monthly expenses. When you finance a car, each monthly payment brings you closer to owning the car outright.

Housing Wire

AUGUST 23, 2023

Following a merger with special purpose acquisition company (SPAC) Aurora Acquisition Corp , Better Home & Financing Co. New York-based digital lender Better.com has shifted its strategy ahead of its initial public offering (IPO). is expected to begin trading on the Nasdaq Stock Exchange on Thursday under the ticker symbol “BETR.”

Housing Wire

JUNE 29, 2022

Many millennial and Gen Z future homebuyers are concerned about the effects of personal finance issues like having insufficient savings, increasing debt and low credit when applying for a loan. Today, 78% would apply for a loan with less than the traditional 20% down payment, while more than half (55%) do plan to put down at least 10%.

Realtor.com

NOVEMBER 28, 2022

designer491/iStock FHA loans, which are insured by the Federal Housing Administration, help home buyers secure financing to buy a home despite their low income, lack of savings, or poor credit scores—the kind of things that often prevent people from getting a conventional loan. A maximum debt-to-income ratio of 43%.

Housing Wire

AUGUST 11, 2020

By providing an exception to the general QM loan definition’s strict 43% debt-to-income ratio threshold and rigid income and debt verification criteria, the GSE patch facilitates access to affordable mortgage credit for credit-worthy borrowers who fall outside the requirements of the general QM definition.”. “The

Housing Wire

JANUARY 14, 2022

The Federal Housing Finance Agency recently announced new upfront fees for second-home loans which, much like the abrupt and now-suspended caps on such loans last year, are expected to give the private-label securities market a boost. The new rule is slated to be implemented on Oct. 1, 2022.

Realty Biz

AUGUST 20, 2023

By understanding the ins and outs of mortgage pre-approval, you will be better equipped to navigate the home-buying process and make informed decisions regarding your budget and financing options. Preparing Your Finances for Mortgage Pre-approval Preparing your finances is an essential step to getting pre-approved for a mortgage.

HomeLight

NOVEMBER 29, 2023

Especially in today’s market, where inventory levels are low, and prices are soaring, aligning the timing and finances of both transactions can be particularly challenging. Bridge loans are sometimes referred to as gap financing or swing loans. An important factor in this process is your debt-to-income ratio (DTI).

HomeLight

JANUARY 17, 2024

Here are some common reasons why you might decide to back out of a home purchase: Your loan financing fell through: It’s not uncommon for a mortgage loan to be initially approved but later denied due to changes in your financial situation or lending policies.

HomeLight

FEBRUARY 28, 2024

When buying your first home, you typically have more financing options that break the “20% down payment requirement” myth. A second home loan backed by Fannie Mae will typically need a score of 640, a 25% down payment, and a debt-to-income ratio below 36%. What’s the minimum down payment for a second home?

HomeLight

DECEMBER 5, 2023

Your lender might need to crunch the numbers and calculate your debt-to-income ratio (DTI). To help you understand the financial aspects, check out these handy tools: Calculate your down payment Estimate your closing costs Check your debt-to-income ratio What are the benefits of a bridge loan in Connecticut?

Realty Biz

OCTOBER 25, 2021

If you don’t have enough money to buy a new property then financing is a great solution. Financing can provide the support you need to buy the house you want. Financing in the form of mortgage refinancing can reduce your expenses and help you pay off your mortgage faster. Mortgage refinancing tends to be an easier process.

Realtor.com

FEBRUARY 3, 2022

The answer to this question is all the more critical in today’s red-hot, warp-speed market, where you won’t stand a chance without a clear picture of your finances. What is debt-to-income ratio? Your overall debts, compared with your income, define your debt-to-income, or DTI, ratio.

HomeLight

NOVEMBER 7, 2023

As a short-term financing solution, bridge loans empower you to leap ahead to purchase your new Oklahoma home before saying goodbye to your old one, helping you keep all the pieces in place without the interim shuffle. In simple terms, it’s a short-term loan that uses the equity in your existing home to help finance the new purchase.

HomeLight

FEBRUARY 26, 2024

Denise Madan , a luxury home real estate agent in Florida with 25 years of experience, explains that, initially, the process mirrors a traditional home purchase, but then often requires some creative financing. This approach leverages the value you’ve built in your current home to help finance a more expensive one.

Housing Wire

MAY 25, 2022

Partnering with a team that understands how to approach home loans for borrowers with complex finances can make the difference between another year of profit growth and the unfortunate possibility of loss in business, making it one of the most crucial decisions for any lender.

Redfin

JUNE 30, 2023

However, with rising real estate prices, some may find themselves seeking financing beyond the conforming loan limit. It’s a mortgage loan that allows homebuyers to finance a property that exceeds the conforming loan limit set by the FHFA. In this instance, you’d need to apply for a jumbo loan. What is a jumbo loan?

HomeLight

JANUARY 29, 2024

High debt-to-income ratio: Traditional lenders often shy away from borrowers with high debt-to-income ratios. Solutions for the self-employed: Self-employed individuals often face hurdles in proving consistent income, a requirement for traditional loans.

HomeLight

DECEMBER 15, 2023

A bridge loan is a short-term financing solution, giving you the necessary income to purchase a new home, even before you’ve sold your current one. A bridge loan is a practical, short-term financing solution designed to “bridge the gap” for homeowners like you. What is a bridge loan, in simple words?

Redfin

MAY 12, 2023

When it comes to purchasing a home, buyers may find it difficult to find financing beyond the conforming loan limit. A jumbo loan is a type of mortgage that’s designed to help you finance the purchase of a home that exceeds the conforming loan limits set by the Federal Housing Finance Agency. What is a jumbo loan?

Lighter Side of Real Estate

SEPTEMBER 23, 2021

Increasing the balances on your credit cards can impact your debt-to-income ratio, which plays a major role in determining whether you’re approved for a mortgage—and, if so, how much. In order to qualify as a solid candidate for a mortgage, lenders want to see a stable job history and reliable income.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content